A SalesWisdom Industry Insight 2023 and beyond: Challenges facing insurers

Overview

Insurers face significant risks and opportunities as they look to achieve organic growth in a rapidly and radically changing world. These thoughts make use of reflective practice – a highly relevant but under-used approach in the world of selling.

They draw on the SalesWisdom team’s long and strong pragmatic experience of developing over 10,000 professionals from more than 500 businesses around the world – many of these have been insurance firms from regional brokers and specialist actuaries to global providers in both Life and Non-Life.

We present 10 ideas which we believe will make a difference in driving organic sustainable growth in the months and years ahead:

- Why cross selling has failed and how it can be flexed to succeed

- Be a problem finder not a problem solver

- Three levers to ensure success

- Bring value to the whole business

- A challenging market

- Build and accelerate trust

- Differentiate yourself

- Make the financial case

- Behaviours for a hybrid world

- Lead business growth

1. Why cross selling has failed and how it can succeed

The classic example of this is Wells Fargo who ended up being fined an estimated $3Billion after a Congressional Commission took them to task for their cross selling. It started well with the premise that the more products a customer takes from us the better deal they get because the better we understand them. Their mantra “Eight is Great” set a target of eight products per customer. This succeeded even though it put some sales staff under pressure so they upped the game and went for “Then Again Ten”. At this point sales staff were under so much pressure they were creating ghost accounts and Congress heard from one member of staff whose job was to counsel customers with payment problems but who was still being targeted to sell them another financial product! Wells Fargo was an extreme example but there others across financial services. No wonder clients, relationship managers and regulators are averse to cross-selling.

So what’s the answer?

- Change the language:” New From Existing” not “Cross Selling”.

- Understand that this is not about force-feeding new products to a broker or client until they scream for mercy. It’s about understanding them enough to identify what could benefit them and then helping them make sense of this.

- Consider 5 critical success factors:

- Be customer-centric. Don’t ask “How we can sell them this?” Ask instead “why should they consider this?” People want to hear good ideas from us if they feel we have their interests at heart. As one client put it “You have worked with us for years and really know us well. I expect you to come to me with new ideas you think we need to hear. Don’t expect me to takeyou up on everything you bring but I do expect to bring me ideas.”

- Trust: If I am to let you loose on “my” client I need to trust you to behave correctly, not oversell, not to let me and the client down. I need to know you will do the right thing rather than just sell something that helps you achieve your target. I need to trust you to keep me informed. Trust is key and we need to manage the trust – internally and externally.

- Process: An effective “New from Existing” sales process is key. How does the generalist introduce a new idea? When is the right moment? When do they introduce the Subject Matter Expert? (Too late and the generalist may have mis-sold; too early and it wastes expensive SMEs’ time.

- Recognition: Whether it’s hard cash (risky), wooden dollars (dubious, or chocolate cake (nice!) people need to feel they are recognised or rewarded for going the extra mile to introduce solutions that they are not directly responsible for. It’s not just about “what’s in it for me?”. It’s about the reality that if I spend time on this I can’t spend time on my core responsibilities. It is important to get recognition and reward right.

- Knowledge: It’s crucial to get the balance right here. Some firms won’t allow people to talk about a service until they are expert in it. It’s impossible to know everything about everything – from cyber to employee benefits. On the other hand we need to know enough to introduce the subject and begin to qualify the opportunity. There are good ways to get the balance right but it needs to be done in the right way. Armed with just enough knowledge we need to find the right words. As one relationship manager puts it: “I’m not an expert about what we do in this area, but I am an advocate of what we do. I’d really like you to speak with xxx.”

These success factors make a huge difference to both clients and relationship managers.

2. Be a problem finder not a problem solver

In the past the main role of anyone whose job involved selling was to identify a specific requirement and provide a solution that addressed that requirement. This paradigm underpinned the whole approach known as consultative selling. It adapted over the years with concepts such as the challenger sale but has remained largely unchanged since the 1980s. It produced some very effective approaches such as Huthwaite’s SPIN or Mercuri’s DAPA and a host of variants.

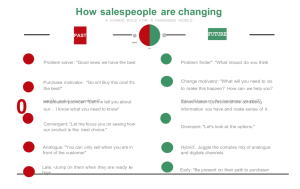

The core skills of consultative selling remain useful and valid although they need to be adapted to the many changes we have seen in the first two decades of this century and will see in the next two. However the role has changed. It can be summarised like this:

We highlight two aspects in particular:

Problem solver

The relationship manger needs to be continuing looking out for issues in the customer’s business. Quite often they will be seeing things before the customer themselves do. For example the RM may be aware that a particular policy will be hard to place in 8 months’ time given the customer’s profile; or they may be seeing a trend across their portfolio that the customer has not spotted. If the RM can begin to open the customer’s eyes to this potential problem then there will be time to build the right solution and the customer will see them as a trusted advisor not an aggressive product-pusher.

Sense maker

There is a good deal of thinking going into this aspect of selling. The argument is that buyers (who used to rely on sellers for all sorts of information) are now at least as well informed as sellers. They have access to rich online resources and can validate their opinions through social networks. The problem is that most of us suffer from too much, not too little information. Much of this information is contradictory. The role of the salesperson or trusted advisor is to help the buyer make sense of all this information and form judgements. This may involve understanding what the issue is they are trying to resolve, understanding what sources of information they have been accessing, and may well involve talking openly about differences between what you are proposing and what other providers are telling them. All this requires a different mindset, different timing and different questioning technique.

3. Three Levers to endure success

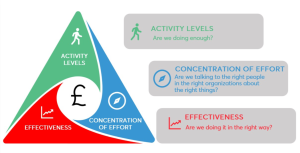

We chose the name SalesLevers for the development, process and tools aspect of our business because we believe there are really only three levers sales leader can use to drive organic growth.

The idea was borne out of observing the huge number of building sites in Jakarta during a sales performance project in that high-growth city.

Each building site was served by a crane. If the crane worked well, the building site worked well and the buildings grew. The crane driver in their cab really has only three levers.

They can move and boom around. They can move and hook along the boom. They can raise and lower the boom.

In the same way SalesLevers has three levers:

- Levels of activity: People spend more time selling or we hire more sellers.

- Concentration of effort: People are talking to the right people in the right organisations about the right things.

- Effectiveness: Individuals have the right talent, attitude, skills, knowledge and style. The organisation has the right sales enablement structure, processors and tools in place.

This ACE model has proven to be a simple but highly effective way to prioritise sales improvement projects and optimise return on investment.

4. Bringing value to the whole business

When we looked at cross selling or rather “New From Existing” (NFE) we saw that this must start with the customer and their needs. In the case of intermediated relationships this means focusing on both the distributer and the end client.

To be effective the relationship manager needs four levels of knowledge.

There are a number of techniques and best practices available to ensure these four levels of customer knowledge are in place.

Our professional need to have an interest in and appreciation of the world scene. They need to keep themselves informed and relevant.

They need to appreciate what makes the client’s sector different and speak the client’s language.

They need to understand the business as a whole, using tools such as The Business Model Canvas.

Finally, they need to have good understanding about the transaction itself.

On top of customer knowledge the effective relationship manager needs:

- Product Knowledge: Deep in their specialist area and broad on topline understanding of the wider offerings of the business.

- Competitor knowledge: Both macro (corporate strengths and weaknesses) and micro (the position on the ground in their area). Competitor battle-cards can be effective tools.

- Own-company knowledge: Understanding both the hard and soft elements of the business from culture and values and politics to structure, financials and policies.

- Technical knowledge: This will be required to varying degrees depending on the role.

Armed with this knowledge they need to be able demonstrate exactly how any proposed solution will bring tangible value to the customer.

By focusing on value they will differentiate themselves and be seen as trusted advisors rather than just product pushers. This is not only much more effective; it suits the preferred approach and mindset of most relationship managers.

“Value Selling” and “Customer-Specific Value Propositions” are big topics but are critical success factors when it comes to growing existing relationships.

5. The challenges of a hard market

As the Deloitte 2023 Insurance Industry Outlook puts it “The road ahead is dotted with multiple hurdles-rising inflation, interest rates, and loss costs; the looming threats of recession, climate change, and geopolitical upheaval”

While many of the structural issues lie outside the scope of this paper there are a number of things relationship managers need to be doing:

- 1. Allow more time. Flag up possible challenges earlier in the cycle. This is not the time to be starting work at “two minutes to midnight”. Build in conversations immediately the renewal has been transacted or build in a business review at the end of the first quarter: “I know it’s a long time until your renewal but in the current market a number of our clients are taking a moment to step back, consider their overall approach to risk and thinking about what they could be doing now to be ready for the future…”

- Focus on the strategic imperatives. In challenging times business cut back on the “nice to do”, the discretionary spends and concentrate on the matters that are critical to their survival and success. Make sure you are aware of and focussed on what matters to them. As one French consultant put it: “We must stop being an interruption to what matters most to our clients and become what matters most to them!”

- Look at actions the client can be taking: This online advice from one U.S. broker is a good start point.

a. Review your coverage: Make sure you have the right amount of coverage for your needs. You don’t want to be underinsured if you need to make a claim.

b. Shop around: Get quotes from different insurance carriers and compare rates.

c. Increase your deductible: This will lower your premium but make sure you can

still afford the out-of-pocket costs if you need to.

d. Work with a good insurance broker: A great broker will review your claims

history, coverage needs, and budget to find the best possible option for you.

e. Take steps to mitigate risk: Take measures to reduce your risk of having to

make a claim. This could include things like installing a security system or

quitting smoking. The hard insurance market is upon us. - Be ready to explain and justify rates etc. as outlined in section 8 below.

6.Build and accelerate trust

In changing times trust and trustworthiness are at a premium. Trust is a strange concept. It’s hard to define but you know when it’s missing. But trust is not in fact random. It is a manageable process; and it can be accelerated.

Over the past five years we have seen the impact of working on trust-based relationships with people ranging from investment professionals to managed services providers in sectors including financial services, manufacturing and distribution. We have been struck by how eager people have been to grasp the concepts and how enthusiastic they have been when telling the stories of how it has helped with everything from professional and personal relationships to profit margins.

The focus of the work has been on how organisations and individuals can be seen as trusted business partners by the clients and other stakeholders.

Here are some of the lessons we have learned along the way.

Three phases of trust

Rachel Batsman (“Who can you trust?”) argues powerfully that we are in the third phase of trust.

- The first phase of trust was local trust. We knew everyone in the village and knew who we could trust.

- The second phase was institutional trust. With the arrival of the industrial revolution, urbanisation and globalisation we couldn’t know whom we could trust individually so we placed our trust in institutions – financial, political, the press…. We also placed trust in the experts within those institutions.

- But over recent years many institutions have forfeited our trust and we have turned our backs on institutions and experts. We have moved instead to the third phase of trust – “distributed trust”. This is typified by the trust we place in AirBnB and the like, relying on platforms and relationships with people we have never met. In this changed trust environment we need to recalibrate the approach we take to building and fostering business relationships.

Trust taxes and trust dividends

One of the most exciting aspects of trust is the way high trust saves and low trust costs. These “trust taxes” and “trust dividends” may be in the form of money, time or stress. It’s one of the central arguments of “The Speed of Trust” (written by Stephen MR Covey). He gives example after example where high levels of trust have meant agreements go through faster, where trust-based relationships reduce delays and costs. He is clear that this is not a matter of naive optimism but of optimism “with its eyes open.” He is also clear that trust is not achieved by chance. Nor is winning or losing it inevitable. He looks at four things we can work on to build trust:

Integrity

In practice this is about honest and open communication. It challenges us to have the courage to call things as we see them and to be faithful to our principles and the business’s values. Courage involves demonstrating that we do the right thing even when it’s hard or costly.

It also means “walking the talk” aligning what we do with what we say: congruence between what we say and do.

It means displaying humility. Humility: is not the opposite of confidence but the opposite of arrogance. It does not mean being self-deprecating or apologetic. What it does mean is recognising that we don’t know everything, that the other person may have a valid viewpoint and approaching every opportunity with a willingness to learn as well as to impart information.

Intent

Covey points out that we want to be judged on our intentions but we will actually be judged by our actions. He argues that we can really accelerate trust if we state our intentions openly at the start and then of course deliver on them. Explaining up front how you intend to act and what you will be aiming to do can seem quite alarming but it is worth experimenting with. The effect on a new relationship can be extremely positive.

Capabilities

Trust will be speeded up if we “run with our strengths” rather than try and either bluff our way through or try to take everything on our own shoulders. This can involve bringing expert colleagues where we are not the best person to explain something. It also means continually “sharpening the saw” to ensure our capabilities are up the mark for the changing demands of new customer acquisition. It certainly involves keeping ourselves relevant to prospects and those around us by keeping on top of issues in the wider world, in the prospect’s sector and in our own organization.

Results

The fourth aspect of accelerated trust that Covey highlights is being able to talk credibly and convincingly about results. This is about coherent, clear conviction rather than hollow bragging. We need to be able to back up claims with evidence even before that evidence is demanded. We avoid exaggeration and empty claims but we do make our case robustly. Having case studies, testimonials, worked examples – these all contribute to an effective communication of the results we have achieved with others and the results the prospect can expect.

Competence & Character

Stephen MR Covey’s father Stephen Covey began to explain how we build trust in his “Seven Habits”. He talked about the balance between character and competence. Think about the small things that demonstrate character in the early stages of a relationship: being on time, your appearance, the interest you show in the client, the way you carry yourself. Think too how you can demonstrate your competence early in the relationship: often this is more in your intelligent, well-informed questioning than in trying to impress them by telling them things they know already.

The trust equation

Trust

Our customers trust us because they see both who our character and competence. One without the other is not enough.

Your capabilities. What you know and how you add value to the customer

We also gained hugely from the work done by David Moister, Charles Green and Robert Galford in “The Trusted Advisor”. In this excellent book they offer this helpful formula that explains how trust is built with clients and partners.

T (Trust) comes from:

Credibility (C) comes when we can make connections between the client’s issues and our knowledge and experience.

Reliability (R) builds trust when we simply demonstrate that we do what we say we’ll do. It’s about consistency and dependability. It’s about “no surprises”!

Intimacy (I) comes from frequency of contact and from the nature of that contact. It is not helped by over-familiarity or “product push”. It can be face-to-face or remotely and even digitally. It can exist both between individuals and organisations.

Self-orientation (S): All this is reduced by the extent to which the client gets the impression that the professional is on their own agenda rather than his. It’s all about customer-centricity not self-centeredness.

Looking at trust through these different lenses has given us powerful tools for building and maintaining trust at both corporate and individual levels. The models have prompted rich debate and practical solutions. In a changing trust environment we need changing strategies. It has been exciting to work on this challenging subject with such responsive groups.

A practical exercise on trust

Please follow this link to complete a small quiz on Trust

7. Differentiate yourself

One of the things we hear again and again from professionals is that clients find it hard to tell them and their offer apart from their competitors. They see their personalities and their solutions as being very distinctive

and it really upsets them that the client

cannot see this. But it’s very understandable because to be honest, risk managers, accountants, advisors, lawyers; all too often look the same as the other risk managers, lawyers, accountants, advisors. And they do talk about the same things. The solutions are often similar and everyone says they really focus on relationships! So how can we differentiate ourselves?

We can differentiate in two ways

Differentiate on style

These two things can come together for real differentiation. Let’s take an example of an audit partner trying to differentiate on a fairly commoditised audit offer. They were bidding for some business, and they knew that they had to do something pretty radically different to unseat the incumbent, who was well positioned. What they did was they set up display boards around the room, telling the story of their firm and how specifically, their audit would make a real difference to the client and they walked the client around the room. The result? One won audit! Of course this will not happen every time. Of course there is a risk of going over the top, but style can make a difference.

Differentiate on substance

Can you identify a handful of things that make your offering genuinely different from your competitors? Don’t worry, if you can’t differentiate on everything. It’s okay to be equal to your competitors on 80% or even 90% of the solution or approach if there is a difference in two or three things that really matter to the client. So look for the points of difference in the places that matter and remember, “equal to or better than”.

Substance AND Style

We said earlier that style and substance can come together in a very powerful way. We will take a concrete example of an experience on an audit committee for a not-for-profit organisation. We had 4 firms on our shortlist and each one was asked “Please tell us what makes you different.” The first three just came up with the usual humdrum answers, but one firm got it really right. The lead partner said “let me tell you what makes us different. A few years ago, the firm I was in decided to stop its not-for-profit practice. As the practice leader, I had to figure out where to pursue my career and my people’s careers. So I looked around the market for the firm that really chimed with its clients. I saw this firm was doing a great job and I brought my career to this firm, and I bought my peoples careers to this firm. And that’s why I believe you should bring your work to this firm too.” He was very confident and very considered in style and his substance gave us a real reason to move.

Conclusion

Think how you can differentiate yourself. Don’t be surprised or affronted if clients can’t see at first what makes you different. Work hard on style and work hard on substance and you will come across as different.

8. Make the financial case

In an inflationary environment many sellers are needing to find ways to explain why prices are going up.

Earlier this year we worked with a boutique pensions trustee business who needed to increase their prices for the year ahead. In a six week campaign they achieved an average 6.8% increase in a competitive market. Here are some of things they did:

- Made sure of their facts: Part of the justification was that their salary costs were going up in line with inflation. They were transparent in quoting the specific DWP figures for the month in questions showing both general wages and those in the business services sector.

- They prepared well: The finance team provided good data so they went into their meetings feeling on top of and confident in their facts.

- Cited relevant figures: They demonstrated that another significant cost had increased. They showed how although their fee income over five years had increased by 100% their Pl costs had increased by 10 times despite making no claims.

- Compare with the client: In many instances the clients were increasing their fees by a similar or greater amount.

- Used absolute numbers not percentages: Rather than talk about 10% they pointed out that this was an increase of £400 a month.

- Made the leverage argument: It might be true that some of the pensions administrators they managed for the client were putting their fees up by a lower % but 5% on a £1Mn fee was £50,000 increase compared to their £5,000 increase. They were worth the extra £5000 for the saving they brought the client on their administration fees.

- Deliberate decisions: Each trustee director thought hard about when and how to raise the price increase. They were very deliberate in choosing to raise it at the start or end of a regular meeting, picking up the phone or sending a simple advice note.

- Watch your language: They were much more considered in their choice of words and tone of voice.

- They shared experiences. In the past these experienced professionals had approached this single handedly. This time they told each other what was working and sought advice from each other.

- They tracked the numbers: The finance team kept track of what was happening and communicated well. This gave people confidence that their pricing strategy and tactics were working

9. Behaviours for a hybrid world

Covid accelerated a trend that was already visible. Remote meetings on Zoom or Teams were becoming more frequent but Covid meant they became the norm. It is clear that work patterns have changed permanently. How do we respond to these changes in buying behaviour?

- Lift sales activity: One of the opportunities of the hybrid sales approach is to increase the overall number of contacts with a customer portfolio by mixing physical visits and remote contacts.

- Adjust the contact modes and frequencies by mixing face-to-face and remote selling: It is vital to review the sales process, and decide on the stages that require a virtual approach and those where it is more relevant to focus on a face-to-face approach.

- Combine marketing and sales: The battle between marketing and sales is a classic and negative scenario. In today’s changing world, it is unacceptable to continue to allow these teams to have their own agendas.

- Define new activity monitoring indicators: In the world before these changes, it was relatively difficult to obtain reliable information on the activity of salespeople. Remote selling makes metrics more reliable. Some existing KPls remain essential, others are newer, all are important to measure performance and deduce what should be done to improve performance.

- Bring more added value during face-to-face visits: If the frequency of face- to-face visits drops, it is necessary to ensure that each visit brings substantial added value to the customer. This will require better prepared visits, more structured visits, visits that will produce results.

- Guarantee quality remote interactions: There is no shortage of videoconferencing tools: Zoom, Skype, Microsoft Teams, Gotomeeting, they are all powerful and easy to use with a little practice. The important thing is to be familiar enough with the tools to avoid fear because as everyone knows fear paralyses, – not recommended in sales!

- Recruit salespeople with the right profile: It has become unthinkable to be commercially effective without mastering virtual selling. It is therefore necessary to revisit the profile of the recruits you are seeking, to hold onto what makes sense but identify the new skills needed for tomorrow’s success.

-

Change culture by encouraging your managers to manage in blended mode: It is more than an evolution. It is a profound transformation, with new tools, new skills, new processes. Management must provide the impetus and maintain the desire.

9. Use of digital selling tools: In this hybrid world it is essential to make use of the right digital selling tools. Including CRM, sales forecasting, remote coaching, interactive learning and content creation and curation.

10. Status of online purchasing: Online purchasing is a must in this changing world of sales. Remember to consider dynamic pricing and keep an eye on what your competitors are doing. The opportunities online selling presents will repay your investment.

10. Leading business growth

In challenging times the value of leadership increases. It will be a pivotal resource in the coming months and years. Here a few things we believe will make a difference.

- Be a multiplier not just an adder: It is tempting to step in to close a deal or handle a relationship problem. This can secure an important short term result but it is just adding to the team’s and individuals” efforts. Seek instead to multiply their effectiveness by using each challenge as a way for them to learn and grow.

- Coach more: There is strong evidence that developing sales coaching capabilities and practices makes a significant difference. Developing the sales coaching skills of first and second line leaders gives one of the best returns on investment available.

- Be more visible not less: There is a pressure to retreat behind the desk into the increasing volume of work involved. Copy one highly effective sales leader at the start of Covid set aside 90 minutes a day to speak with his team, either individually or together.

- Lead from the front. Be more customer-facing: This is not a time for “follow me! I’m right behind you”. In tough times we need higher activity levels. Be seen to be out there with customers. Join calls and meetings. Show to you are committed to customer contact.

- Make use of the data: When feelings are up and down, facts become even more important. Make sure the data is up to date, whether on a CRM or other tool and then analyse it to identify trends. Think how you are communicating data both motivationally, effectively and efficiently.

Rigorous and disciplined but sensitive and appropriate sales management will pay dividends as we face uncertain times.

Conclusions

This paper set out to explore (in some detail) the key issues facing insurers seeking to generate organic growth over the months and years ahead.

The ground we covered was

- Why cross selling has failed and how it can be flexed to succeed

- Be a problem finder not a problem solver

- Three levers to ensure success

- Bring value to the whole business

- A challenging market

- Build and accelerate trust

- Differentiate yourself

- Make the financial case

- Behaviours for a hybrid world

10. Lead business growth

A number of the subjects we have addressed deserve deeper exploration and all the subjects are supported by a range of processes, tools and development options.

There will almost definitely be some issues that apply less to one business than another and there surely be some subjects which are important to you that we have skimmed over or not addressed.

We would welcome the chance to discuss all this and share opinions and experiences.